Vehicle owners continue to pay exorbitant tax as Kerala loath to commence BH registration

Mail This Article

Thiruvananthapuram: Kerala is yet to implement the ‘Bharat’ (BH) series of vehicle registration even seven months after the orders in this regard were issued by the Government of India. Now, the Kerala High Court has directed the state government to allow ‘BH’ series after some Government of India employees and staff of Central public sector undertakings (PSUs) approached it.

However, Kerala’s Motor Vehicles Department (MVD) has decided to appeal against the High Court directive. According to MVD officials, Kerala would suffer a loss of Rs 300 crore in vehicle taxes if the ‘BH’ series is implemented in the state.

At the same time, legal experts pointed out that with 19 states in India already introducing the ‘BH’ series, Kerala was unlikely to receive an exemption. Meanwhile, Kerala also has plans to partially implement the series, similar to Karnataka and Tamil Nadu, where it is allowed only for Central Government staff and those working for Public Sector Undertakings of the Government of India. However, state government staff and employees of private sector companies having offices in four or more states are not eligible for ‘BH’ registration.

Government of India had introduced the ‘BH’ all-India uniform series to avoid the hassles of changing the registration number of vehicles each time the owner shifts residence from one state to another. During the first phase, Armed Forces personnel; employees of Defence organisations; Central and state government staff and employees of private companies having offices in at least four states are covered.

Big benefits for vehicle owners

Under the current Motor Vehicle Rules in Kerala, vehicle tax should be paid for 15 years to obtain the ‘KL’ series in force in the state.

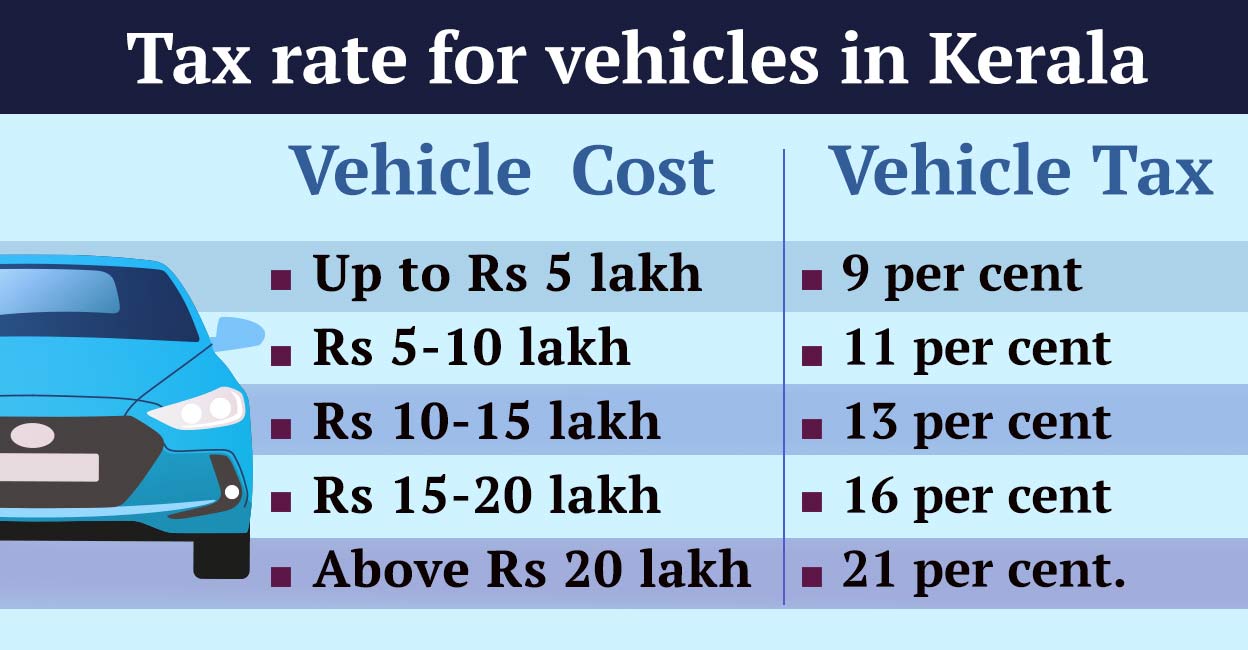

The current vehicle tax for vehicles in different price brackets range from 9 to 21%.

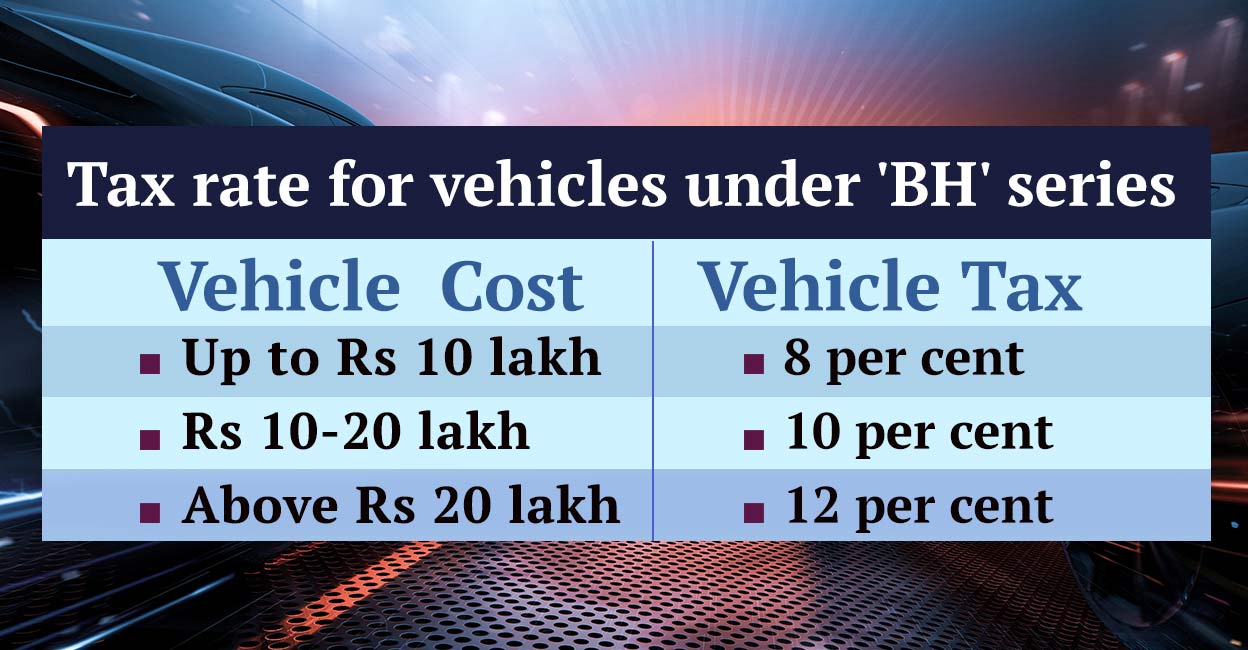

However, under the ‘BH’ system, tax need to be paid only for two years. Moreover, the rates are low.

Taxes under ‘BH’ series are:

Moreover, in Kerala, vehicle tax is calculated over the amount obtained after adding the vehicle price, Goods and Services Tax (GST) and compensatory cess. Presently, Kerala charges 28 per cent as GST and compensatory cess – which depends on the length of the vehicle – up to 22 per cent.

However, vehicle owners would save a big amount under the ‘BH’ series as the tax is based on the vehicle price only.