Water, land, vehicle taxes to go up in Kerala from today | Here's the complete list

Mail This Article

Life in Kerala would be more expensive from April 1, with the State government announcing an increase in numerous taxes and charges. Among the major hikes are related to water charges, land tax, fair price of land and vehicle tax.

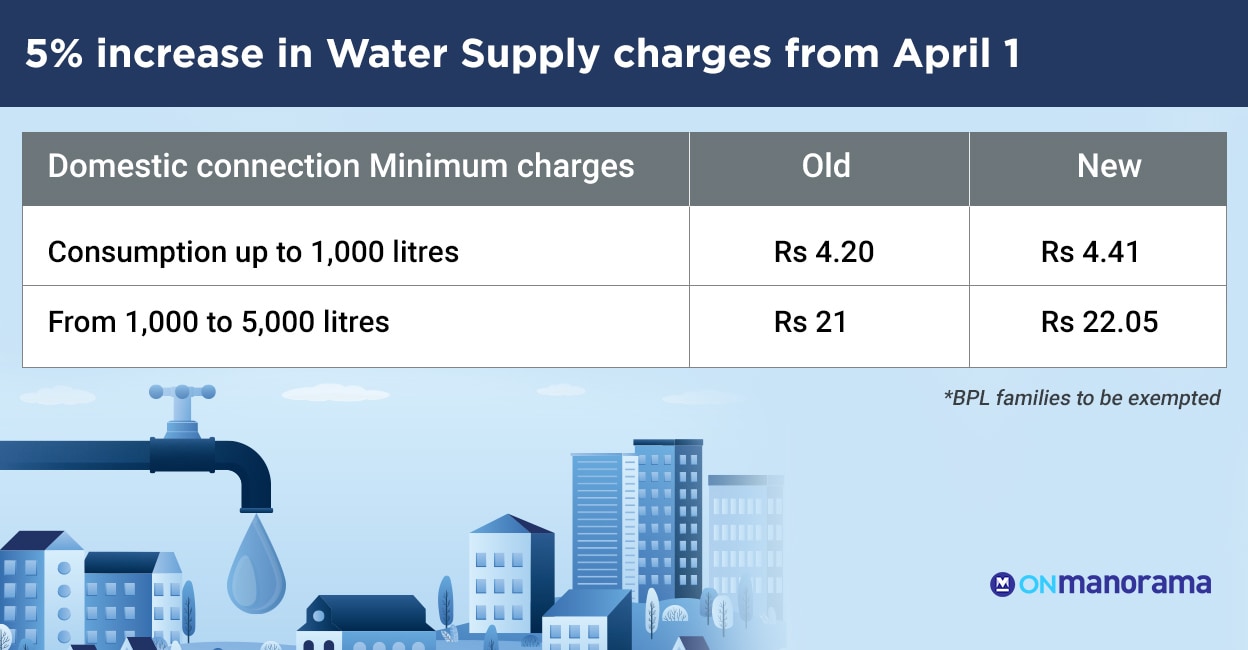

Water charges

A five-percent increase in water supply charges effective from April 1 covers domestic, commercial and industrial consumers. However, people belonging to the BPL (below poverty line) category will continue to be exempted from paying water charges.

Domestic connections: Minimum charges for consumption up to 1,000 litres per month have been raised from Rs 4.20 to 4.41. From 1,000 to 5,000 litres, the minimum rate will be Rs 22.05 instead of Rs 21.

In addition, the fixed rate for non-domestic connections, sewage charges and rates for public taps are also increased.

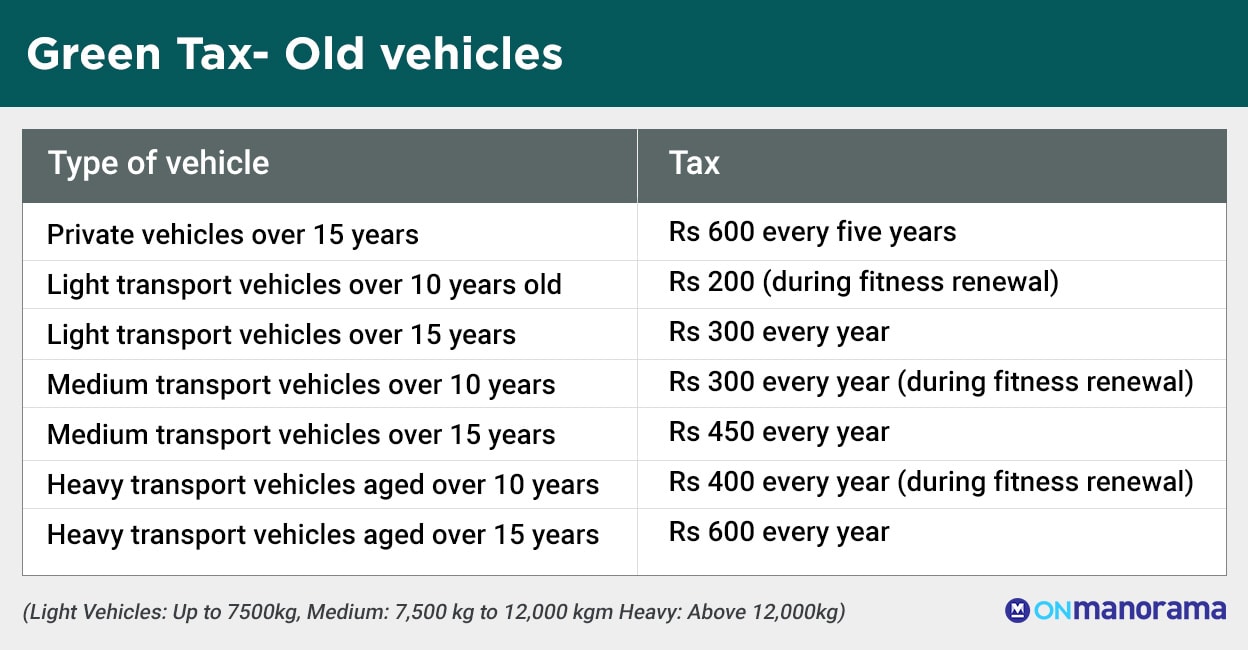

Green tax

A new ‘Green tax’ for vehicles will be implemented from April 1. Moreover, the same tax for old vehicles also would come into force.

Green tax- Old vehicles

- Private vehicles aged over 15 years: Rs 600 every five years

- Light transport vehicles over 10 years old: Rs 200 during fitness test every year

- Light transport vehicles over 15 years: Rs 300 every year

- Medium transport vehicles over 10 years: Rs 300 every year

- Medium transport vehicles over 15 years: Rs 450 every year

- Heavy transport vehicles aged over 10 years: Rs 400 every year during fitness renewal

- Heavy transport vehicles aged over15 years: Rs 600 every year

(Light Vehicles: Up to 7500kg, Medium: 7,500 kg to 12,000 kgm Heavy: Above 12,000kg)

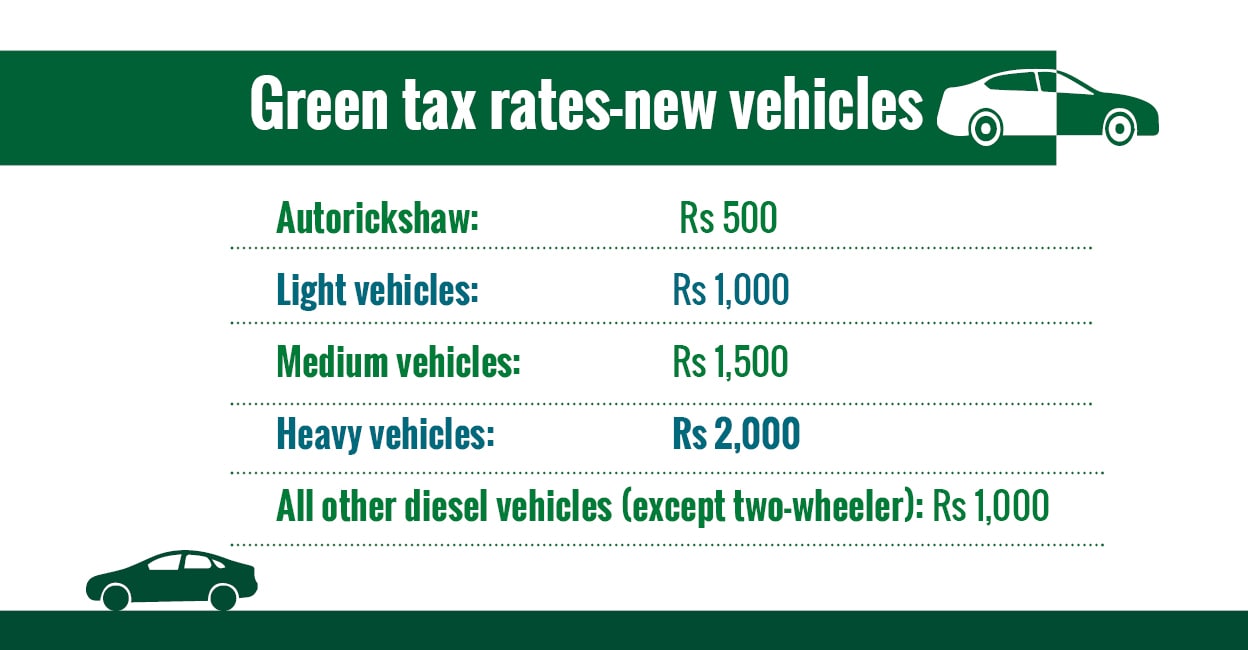

Green tax rates-new vehicles

- Autorickshaw: Rs 500

- Light vehicles: Rs 1,000

- Medium vehicles: Rs 1,500

- Heavy vehicles: Rs 2,000

- All other diesel vehicles (except two-wheeler): Rs 1,000

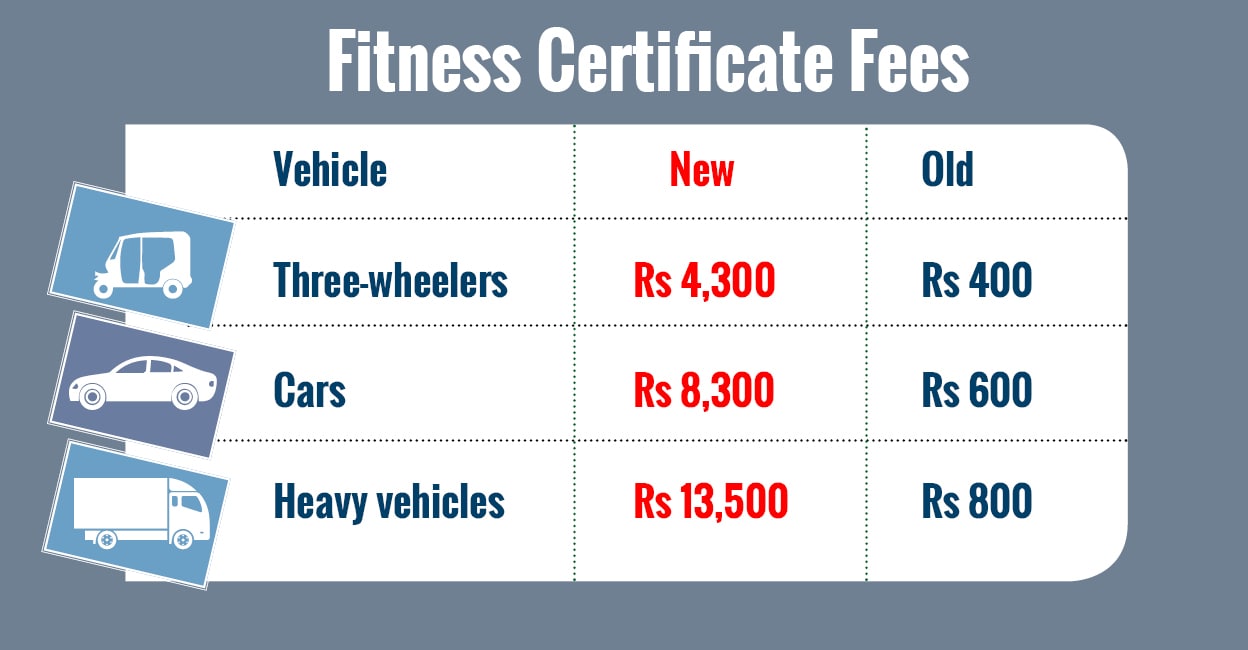

The fees for registration of all category of vehicles and the amount to be paid while applying for fitness certificate also have been increased.

Some fees have witnessed a massive hike. For instance, the registration fees for cars would be Rs 5,000 in place of Rs 600 and for imported cars Rs 40,000 instead of Rs 5,000.

Meanwhile, fitness certificate fees will be Rs 4,300 for three-wheelers (old fee Rs 400); Rs 8,300 for cars (Rs 600) and heavy vehicles Rs 13,500 (up from Rs 800).

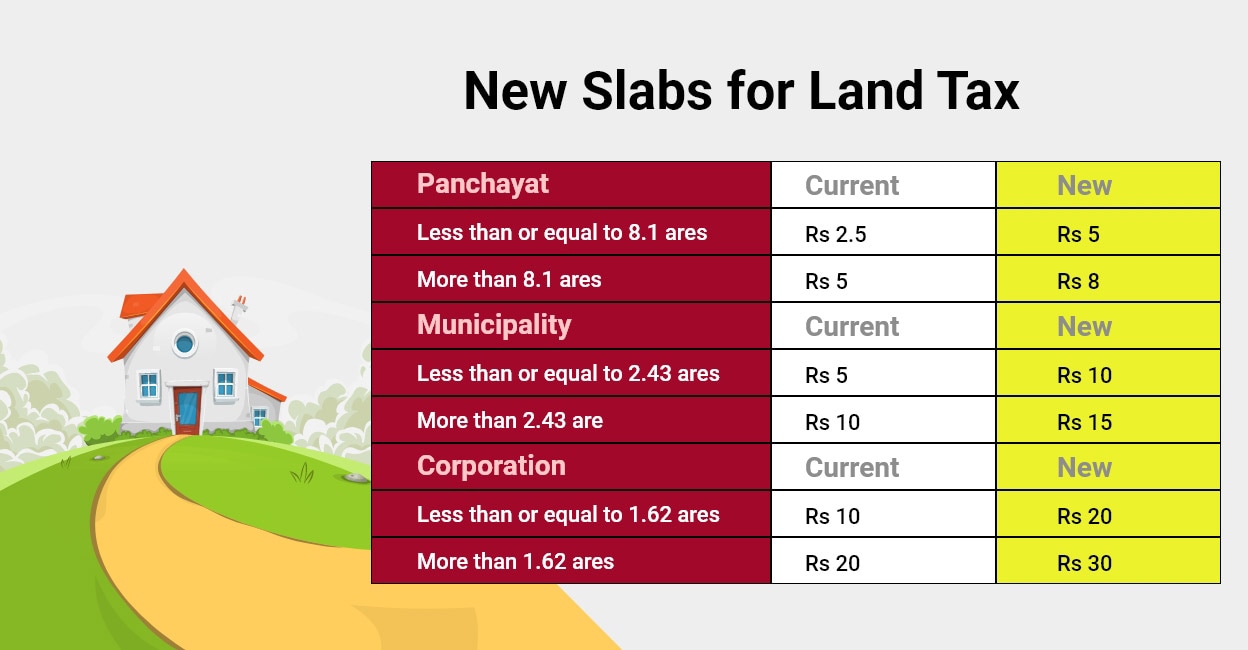

Land tax, fair price

Another significant increase is regarding land tax paid at village office and the fair price of land, which have almost doubled. Incidentally, the hike is effective for even very small plots of land. According to authorities, these charges could now been paid online also. Following the 10-percent hike in fair price, land dealings would be more expensive in Kerala from April.

Other changes

The authorities said that people possessing unauthorized BPL category ration cards could return them by March 31 and be spared of legal action.

Meanwhile, the Excise Department said that all its services would be available online from April 1.