Union Budget 2025: No income tax up to Rs 12 lakh | Check new tax slabs & exemptions

Mail This Article

New Delhi: The Union Budget 2025-26 has brought significant tax relief for the middle class, with Finance Minister Nirmala Sitharaman announcing a substantial increase in the tax exemption limit. Under the new tax regime, no income tax will be payable on incomes up to Rs 12 lakh, with the exemption limit extending to Rs 12.75 lakh for salaried individuals due to a standard deduction of Rs 75,000.

Individuals earning up to Rs 12 lakh (excluding special rate income such as capital gains) will file the returns but get rebates. For the salaried classes, Rs 75,000 will be provided as a standard deduction and for the elderly, a standard deduction of Rs 1 lakh will be available.

The new rebates will be brought about by an amendment to section 87(A) of the Income Tax Act. It is this section that entitles salaried persons to 100% IT deduction. Since 2014, the 'nil tax' slab has been raised from Rs 2.5 lakh to Rs 5 lakh in 2019 and further to Rs 7 lakh in 2023.

Till now, those earning up to Rs 7 lakh a year were fully spared of income tax burden. The amendment will replace Rs 7 lakh with Rs 12 lakh. These amendments will take effect from 1st April, 2026 and will, accordingly, apply in relation to the assessment year 2026-2027 and subsequent assessment years.

If the annual income spills over Rs 12 lakh (plus the standard deduction of Rs 75,000), the taxation would be done incrementally. Say the annual salary is Rs 12.90 lakh. The assessee will have to pay income tax as her salary is above Rs 12.75 lakh, the farthest ‘nil tax’ income limit. In this case, tax will be calculated on the basis of slab-wise (now revised) rates: no tax up to Rs 4 lakh, 5% between Rs 4-8 lakh, 10% between Rs 8-12 lakh, 15% between Rs 12.75 lakh and Rs 12.90 lakh.

If the annual salary is, say, Rs 26 lakh, then the incremental tax calculation will go this way: no tax up to Rs 4 lakh, 5% between Rs 4-8 lakh, 10% between Rs 8-12 lakh, 15% between Rs 12-16 lakh, 20% between Rs 16-20 lakh, 25% between Rs 20-24 lakh, and 30% above Rs 24 lakh.

Since the finance minister has brought down the slab rates, there will be considerable tax savings even for those in the upper slabs. The new tax structure introduces revised slabs and rates across the board, aiming to leave more disposable income in the hands of taxpayers and boost household consumption, savings, and investment.

Revised tax slabs (new regime)

- Rs 4-8 lakh - 5 per cent

- Rs 8-12 lakh - 12 per cent

- Rs 12-16 lakh - 15 per cent

- Rs 16-20 lakh - 20 per cent

- Rs 20-24 lakh - 25 per cent

- Above Rs 24 lakh - 30 per cent

Old slabs (new regime)

- Upto Rs 3 lakh: Nil

- Rs 3 lakh to 7 lakh: 5 per cent

- Rs 7 to Rs 10 lakh: 10 per cent

- Rs 10 lakh to 12 lakh: 15 per cent

- Rs 12 lakh to 15 lakh: 20 per cent

- Above Rs 15 lakh: 30 per cent

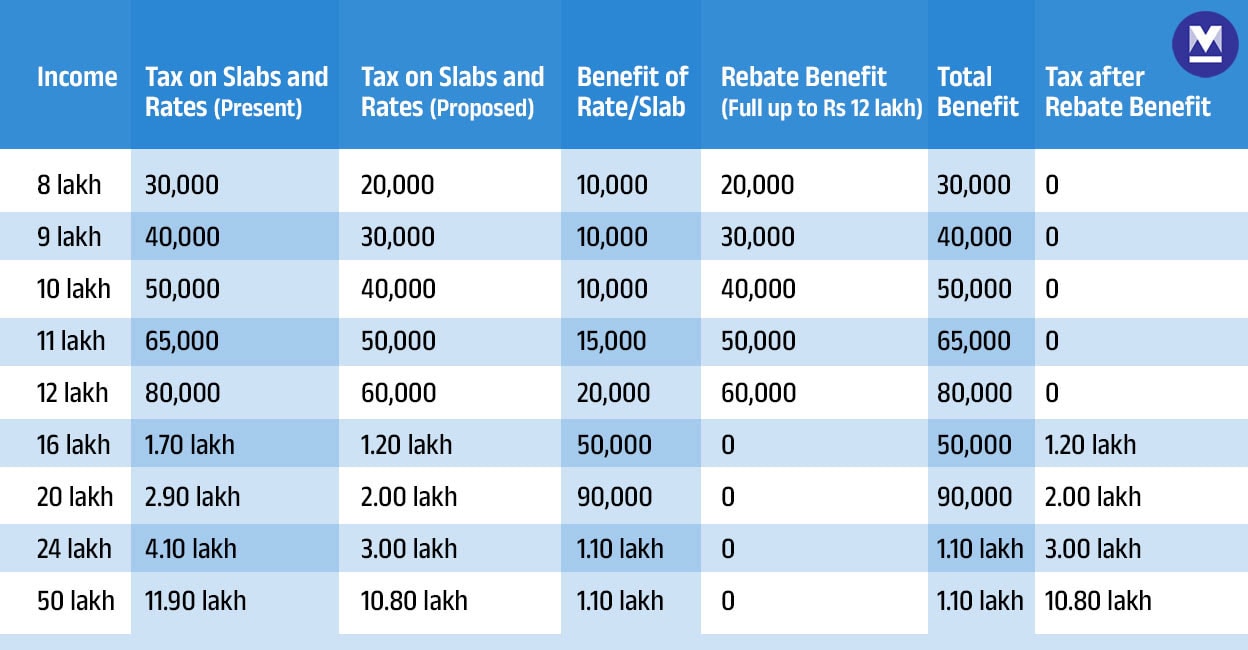

The total tax benefit from slab rate changes and rebates is significant at different income levels:

- A taxpayer earning Rs 12 lakh will save Rs 80,000 in taxes (100% of tax payable as per existing rates).

- A taxpayer earning Rs 18 lakh will save Rs 70,000 (30% of tax payable).

- A taxpayer earning Rs 25 lakh will save Rs 1,10,000 (25% of tax payable).

The government has estimated that these tax changes will result in a revenue loss of approximately Rs 1 lakh crore in direct taxes and Rs 2,600 crore in indirect taxes. However, it expects the boost in consumption and investment to drive economic growth, aligning with the vision of making India a developed nation by 2047.