Scrapping GST is easier said than done

Mail This Article

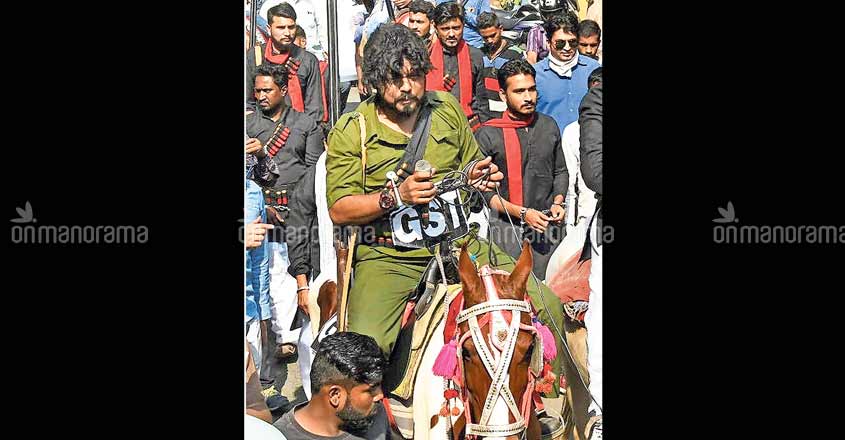

Rahul Gandhi has promised a dramatic decision if the Congress comes to power at the centre in 2019. His party government will scrap the Goods and Services Tax, introduced with much fanfare by the Narendra Modi government less than 15 months ago. Rahul, a bitter critic of the 'one nation, one tax' legislation, has been calling it Gabbar Singh taxation, referring to Hindi cinema's most famous dacoit character.

Like the Rafale deal and demonetisation issues, he has slammed the GST too, which was brought into effect at midnight on June 30, 2017 when then President Pranab Mukherjee and Modi jointly inaugurated the new tax regime while addressing MPs and state chief ministers in the central hall of parliament. The new tax subsumed major central and state taxes including central excise, service tax, value-added tax and octroi. While Modi has said it has caused ease of business, Rahul is the biggest sceptic of all. The Congress president, whose criticisms have also contributed to a number of items being moved to the lesser of the five tax slabs in GST over the last few months, is vehement that GST was an instrument of loot.

Addressing partymen in Bhopal he had said GST was aimed at looting the poor people and small traders, so that the 15 richest Indian businessmen benefited. He has been sharply attacking Modi for tilting government policies and decisions to favour Ambani and Adani groups. Rahul has also promised that there will be a new Goods and Services Tax, which will help the poor and small traders, while taxing the rich. He has also moved away from the earlier Congress demand for one uniform rate of GST for all goods. Finance minister Arun Jaitley has countered Rahul regularly that the concept of one tax, one rate will affect the poor, as the articles of day-to-day consumption like foodgrains, milk, clothing will attract the same tax as luxury goods, consumed by the rich.

Even Congress leaders have not fully developed the alternate model, which is in the mind of their leader. A group led by former finance minister P Chidambaram has been asked by Rahul to flesh out the details of the replacement GST. If the Congress and its pre-poll allies get a majority on their own in the new Lok Sabha, then it would be easier for the party to initiate the legislation. If Modi is defeated, the Congress can claim that he has been defeated on the multiple issues like demonetisation, high prices, GST and Rafale deal. Among the non-Congress opposition parties, only Mamata Banerjee of Trinamool Congress has openly voiced her opposition to GST stating it is against the interest of states. But allies of the Congress from big ones like the NCP, DMK and RJD to small ones like IUML and Kerala Congress(Mani) have not yet promised they will support scrapping of GST.

Further, scrapping GST cannot be done by the stroke of a pen by the electoral winner. In states, chief ministers have signed files to bring in prohibition or selling foodgrains cheap at the swearing in ceremony itself. GST is a constitutional law passed by both houses of parliament and state legislatures. As BJP controls 20 assemblies, it will not easily accept scrapping a landmark legislation. But these are headaches that can be thought of, only when there is a government of the Congress or controlled by the Congress at the centre. Till then Rahul will campaign hard against the ills of GST.