Union Budget Explained | How much you gain from new Income Tax slabs

Mail This Article

Finance minister Nirmala Sitharaman has announced the first major income tax relief for the middle class after 2014. Though the finance minister has not raised the taxable income limit to Rs 5 lakh, as was widely demanded, she has brought down the interest for annual incomes up to Rs 15 lakh. As part of rationalisation, the finance minister has also introduced more income slabs.

But here is the catch: A tax payer will get the benefit of the new proposals only if he forgoes all deductions and exemptions he had enjoyed for home loans, insurance premiums, school tuition fees, post office savings and the like.

The old and the new tax regime will exist side by side. "The shift to the new tax regime is optional," the finance minister said.

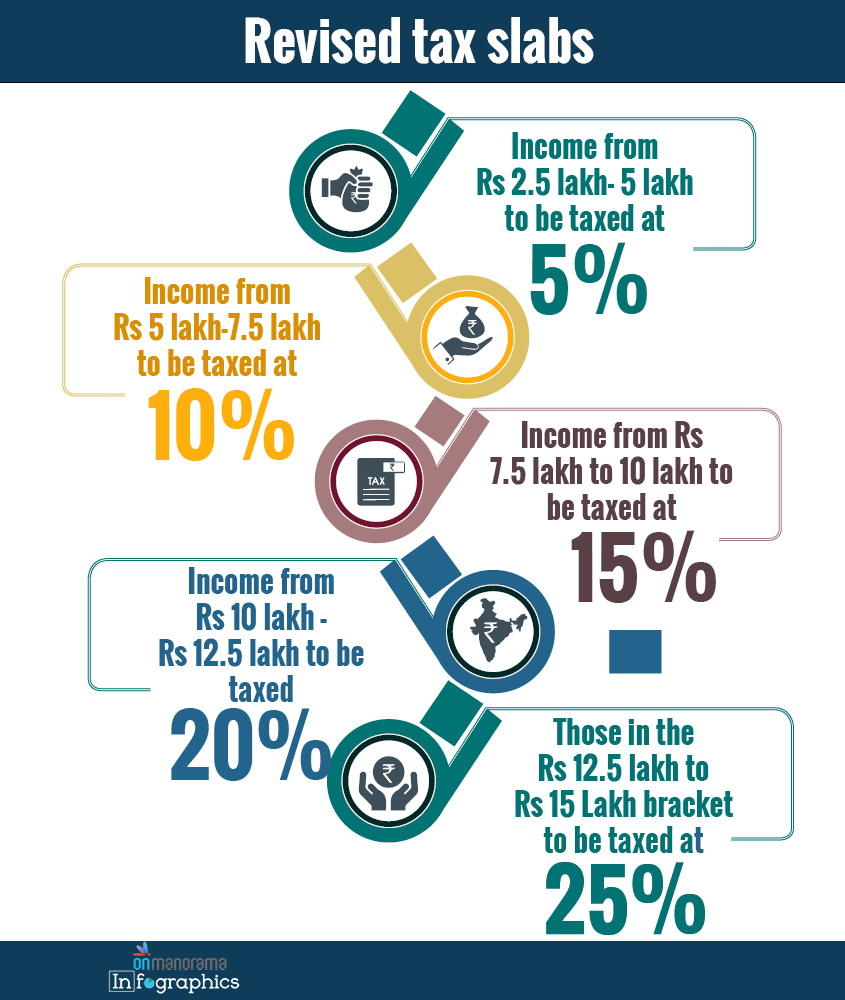

Under the new regime, which will kick in from April 1, 2020, the Rs 2.5 lakh-Rs 5 lakh income slab will continue to attract 5 per cent tax, the only slab that will remain unchanged. The taxable income between Rs 5 lakh and Rs 7.5 lakh has been fixed at 10 per cent as against the prevailing 20 per cent. Taxable income between Rs 7.5 lakh to Rs 10 lakh has been brought down to 15 per cent from 20 per cent.

Under the existing regime, incomes between Rs 5 lakh and Rs 10 lakh were flatly taxed at 20 per cent, but the taxpayer enjoyed the benefits of certain deductions and exemptions.

Also, under the existing regime, incomes above Rs 10 lakh were taxed at Rs 30 per cent. The finance minister has now layered the slabs. For incomes between Rs 10 lakh and Rs 12.5 lakh, the tax has been dropped to 20 per cent from 30 per cent. As for incomes between Rs 12.5 lakh and Rs 15 lakh, the tax will now come down to 25 per cent from 30 per cent.

There will be no changes in tax for annual incomes above Rs 15 lakh. The finance minister, however, has not spoken about taking away the surcharge that had been clamped for annual incomes that exceeded Rs 50 lakh and above.

This major tax relief, which will now shrink the country's tax base, is expected to boost middle class consumption. If not, the economy could be in trouble. Taxpayers in the 2.5 lakh-Rs 5 lakh slab make up nearly 48 per cent of the country tax payer base of 5.87 crore. If the middle class do not spend the extra money that will now come into their hands, consumption would continue to remain dull keeping the economy scraping the ground. Th finance minister said that by this measure the country would stand to lose Rs 40,000 crore.

Nonetheless, the minster said substantial tax benefit would accrue to a taxpayer under the new regime, depending upon exemptions and deductions claimed by the person. "For example, a person earning Rs 15 lakh in a year and not availing any deductions etc. will pay only Rs 1.95 lakh as compared to Rs 2,73 lakh in the old regime. Thus his tax burden shall be reduced by Rs 78,000 in the new regime," the minister said.

The taxpayer would gain further still if she was taking deduction of Rs 1.5 lakh under various sections of Chapter- VI-A of the Income Tax Act under the old regime.

She said the new new tax regime was optional. "An individual who is currently availing more deductions and exemptions under the Income Tax Act may choose to avail them and continue to pay tax in the old regime," she said.

However, the finance minister hinted that the era of deductions would soon change. "In order to simplify income tax system, I have reviewed all the exemptions and deductions which got incorporated in the income tax legislation over the past several decades. It was surprising to know that currently more than one hundred exemptions and deductions of different nature are provided in the Income-tax Act. I have removed around 70 of them in the new simplified regime. We will review and rationalise the remaining exemptions and deductions in the coming years with a view to further simplifying the tax system and lowering the tax rate," she said.