Explained | What happened to the Sri Lankan economy

Mail This Article

From shortage of food, fuel and medicine to long daily power cuts to cancellation of exams due to lack of ink and paper, the problems affecting India's neighbouring country Sri Lanka are myriad.

Sri Lanka is struggling to tide over the massive shortage of essential items brought about by an unprecedented economic crisis.

Huge piles of foreign debt, soaring inflation, depleting foreign currency reserves, devalued currency – Sri Lanka is the living, breathing example of everything that could ever go wrong with a nation's economy and there's nothing the current administration can do to salvage this situation.

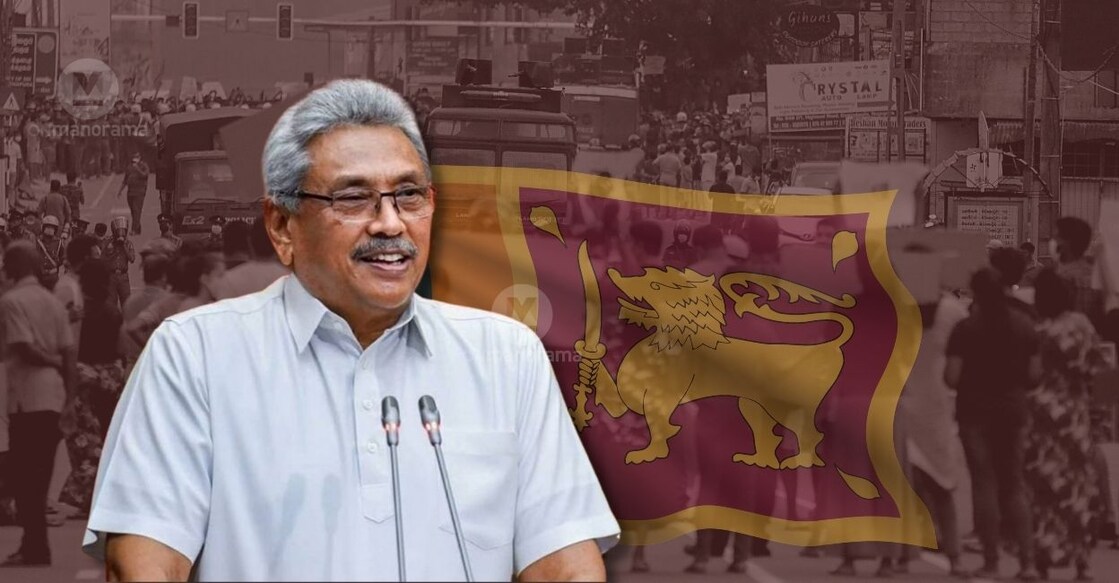

The Finance Minister has been sacked, Cabinet Ministers have resigned, and the clarion call for the President’s resignation is growing. As protests mount, the rest of the world is left to wonder at the root cause of this crisis.

How bad is the economic crisis?

Sri Lanka is going through its worst economic crisis since 1948 when the country gained independence. The prices of essential items like food, fuel and medicines have sky-rocketed.

A kilogram of rice costs 500 Sri Lankan rupees and sugar 290 rupees. When converted, this is approximately Rs 126 and 73, respectively in Indian Rupees.

Citizens have to stand in queues for hours even to get essential commodities. Troops are deployed at state-run fuel stations to help in distribution. The people have to endure daily power cuts of more than seven hours in the scorching heat.

The administration recently had to cancel the school examinations due to a shortage of ink and paper. The inflation in the country surged to 15.1 per cent in February, and its debt-to-GDP ratio hit 119 per cent in 2021.

How did the country come to this stage?

The main reason for the island nation’s plight is the depletion of its forex reserves. The heavily import-dependent country is left with just $2 billion in reserves, leaving Sri Lanka unable to import even basic essential commodities.

Sri Lankan President Gotabaya Rajapaksa admitted that the country has a trade deficit of $10 billion, which is the root cause of the drop in its forex reserves.

The country also has foreign debt obligations of $7 billion, including $1 billion worth of sovereign bonds to be repaid by July this year.

Compounding the problems the country has had its fair share of tragedies too.

The country broke free of the civil war between the LTTE and the government in 2009, but was jolted by the 2019 Easter bombings which claimed many lives.

The pandemic, coupled with bombings, led to a fall in tourism revenues from $7.5 billion in 2019 to $2.8 billion last year. This when the tourism industry was contributing nearly 10 per cent of the of country's GDP.

But fate was not the only thing that drove the economy down.

A blanket ban on chemical fertilisers by the administration last year crippled the agriculture sector, which contributed around 8 per cent to the GDP. Tea cultivation and its exports were, in turn, severely hit by the blanket ban on chemical fertilisers.

Has the Ukraine crisis complicated matters for the island nation?

Many tourists who travel to Sri Lanka are from Russia and Ukraine, and the war has dented their arrivals.

Sri Lanka exports its tea to these two nations and imports almost half of its wheat and sunflower oil from them.

The war has caused oil prices to spike, exacerbating its forex crisis.

How has the country responded to the crisis so far?

In September last year, Sri Lanka declared an economic emergency to control food supply amid soaring inflation.

The country had devalued its currency and imposed import curbs on many items to prevent further depletion of its forex reserves. It had also partially revoked the fertiliser ban.

The island nation has approached the International Monetary Fund (IMF) for debt restructuring and a possible bailout. The IMF said on Tuesday that its monitoring the situation in Sri Lanka 'very closely' and that it is looking forward for a discussion with Finance Minister later in April.

The country needs at least $20 billion for essential imports such as fuel, food and intermediate goods for exports.

Rating agency Fitch estimates Sri Lanka will also need to arrange for $2.4 billion to help state-owned and private firms in the country honour 2022 debt obligations; these will be over and above the $4.5 billion central government debt.

Some experts believe Sri Lanka should establish a more extended repayment structure for debts to lessen the burden on citizens. They argue that instead of being unreasonably committed to repaying debt it is more prudent to press pause on debt repayment and take care of critical economic needs.

Will the crisis affect India? How has India helped its southern neighbour?

On March 22, 16 Sri Lankan Tamils refugees landed on the Tamil Nadu coast. With the worsening situation, more Lankan refugees are expected to reach the Indian shores.

To help its neighbour, India last month offered a billion-dollar line of credit to import food and medicines. It had also extended a $500 million credit line to help Sri Lanka purchase petroleum products.

A few days ago, Sri Lanka sought an additional $1.5 billion credit line to India for importing essentials.

India's island neighbour has brought upon itself a severe burden. It remains to be seen whether the desperate political measures like a new cabinet, resignation of lawmakers and changing the central bank chief will help Lanka salvage the economy that's neck-deep in crisis.