Kerala's fiscal wish list: Isaac proposes, Sitharaman ruthlessly disposes

Mail This Article

If the annual list of demands Kerala has been presenting before the union finance minister feels like a monotonous repetition, it just shows the ever-widening rift between the BJP-ruled Centre and the CPM-led Kerala.

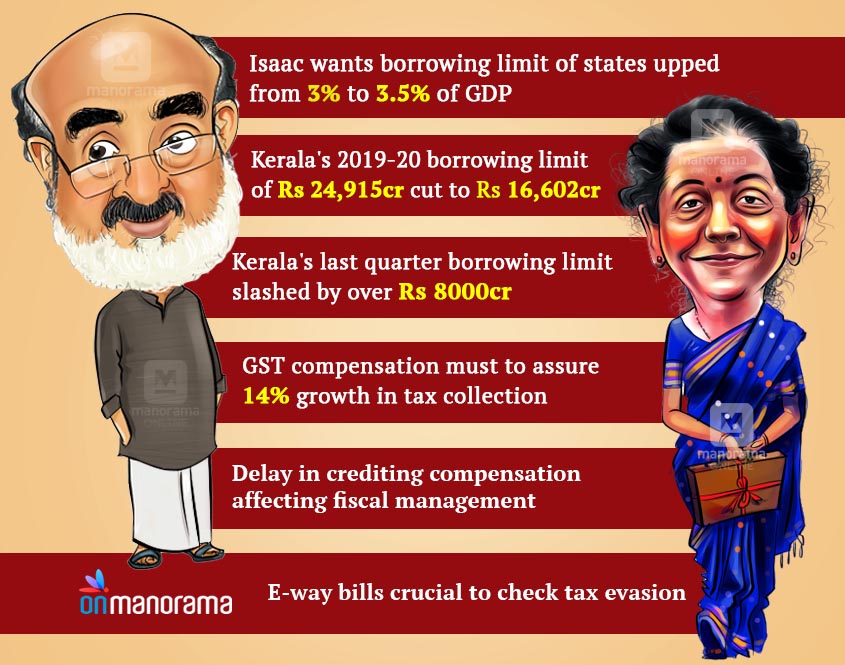

Almost all of Finance Minister T M Thomas Isaac's fiscal wishes have been consistently spurned. Increasing the borrowing limit of the states has been a demand that Isaac had been making ever since he took charge in 2016. The Modi dispensation, even when 'friend' Arun Jaitley was finance minister, had never once deigned to entertain this wish.

Expand borrowing limit

Increasing the borrowing limit is once again the biggest wish Kerala has placed before Finance Minister Nirmala Sitharaman. As it is, a State can borrow 3 per cent of its GDP from the open market each fiscal. Isaac had been constantly demanding that the limit should be pushed upwards to at least 3.5 per cent of the GDP.

Kerala vs Centre tussle:

The Centre had not only been prompt in rejecting his demand but during the ongoing 2019-20 fiscal had even taken away a substantial part of its borrowing rights.

At 3 per cent of the GDP, Kerala is entitled to borrow Rs 24,915 crore during 2019-20. During the last quarter this fiscal, the State's entitlement should have been Rs 10,233 crore. “But the Centre now says we can borrow only Rs 1,900 crore during the last quarter of this fiscal,” Isaac said. “The saddest part is, they have not given us a good enough reason,” he added.

Last fiscal (2028-19), Kerala borrowed Rs 19,500 crore. This fiscal, in the place of Rs 24,915 crore, Kerala can borrow a maximum of only Rs 16,602 crore.

Isaac knows that the Centre would not even restore the original borrowing limit, leave alone raise the ceiling. Yet, despite knowing what would come, the demand has been made once more.

Consider WB loans separate

The next big item in Kerala's economic wishlist is a kind of clarification, and is related to outside borrowing. The State would like to know whether the World Bank loans it had taken for post-flood reconstruction were being considered within the ceiling. “At the GST Council meeting earlier, former finance minister Arun Jaitley had given the assurance that the loans taken by disaster-affected states for reconstruction activities would be considered separately. Jaitley's promise is now being thrown to the winds,” Isaac said.

The World Bank had given Rs 1,789 crore as loan for various reconstruction projects. Isaac fears it had been added to Kerala's quota of annual borrowing. The Opposition had alleged that the Centre is rightly worried that Isaac had used up this money for routine administrative expenses. But Isaac brushes aside the charge. “You can call it diversion or misappropriation if there is no money when the bills are submitted in the treasury for the works that are to be taken up using the World Bank funds,” Isaac said.

Pay GST compensation on time

Kerala is also peeved that the Centre is now refusing to pay even the GST compensation it was by law obliged to pass on. Under the law, Kerala has been assured an annual GST growth of 14 per cent. Therefore, if its tax collection falls under 14 per cent every month, the gap would be filled by the Centre as compensation. As it stands, Kerala's tax growth is just about 10 per cent. The remaining four per cent is paid by the Centre. And the compensation is supposed to reach the State every two months.

Isaac says the Centre is now holding up the payment of compensation. He calls it a disruption of GST tradition. The Central government had defaulted on the bi-monthly compensation payment, due in October, without any notice or explanation. The instalment that should have reached by December, too, was delayed. “We now hear that the Centre is planning to shift the payment to next fiscal. This has created a serious imbalance in the resources position of States,” Isaac said and added: “We want the compensation to reach us the first day of every alternate month.”

Way to go

Finally, Kerala wants the GST Network to be properly in place in 2020-21 fiscal. The State wants E-way bills to be strictly entered in the GST Network so that it could cross check these whenever a vehicle carrying goods crosses the border.

An E-way bill is a bill or an invoice generated online when a vehicle transporting goods moves from one state to the other. Computers installed in the host state could cross-check the invoices using the registration number of the incoming vehicles. The absence of the E-way bill in the initial stages of the GST and its shoddy roll out later on had led to large-scale tax evasion.