Scam-hit Karuvannur bank after poor couple to recover loan, swindlers get waiver

Mail This Article

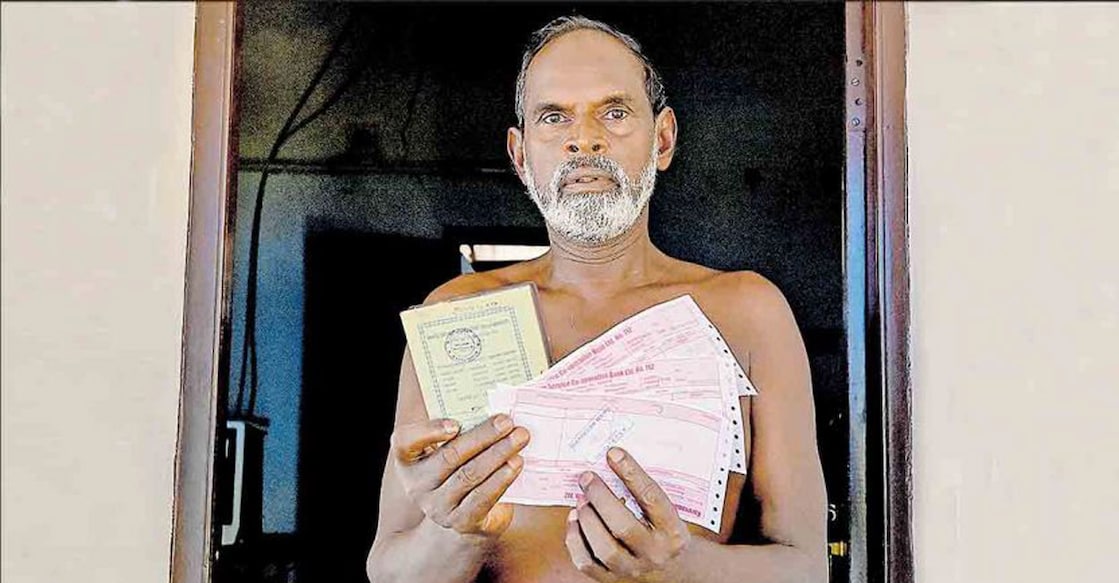

Thrissur: Even as the main accused in the Karuvannur Cooperative Bank scam managed a waiver on their liabilities due to their political connections, ordinary depositors who were swindled by the management have been left high and dry. While several depositors are still awaiting the repayment of their investments, poor couple like Mukundan (72) and Thanka (68) have been served with revenue recovery notice over a small loan initially availed in 2007.

The bank will attach the couple's house and the four-cent plot where it is located if they fail to repay by March the remaining Rs 1.25 lakh out of the loan that they availed for their daughter’s marriage.

The Karuvannur bank officials already came with the attachment threat thrice in the last three months. The threat of losing the property looms large even though Mukundan and Thanka remitted Rs 36,000 and sought more time to repay. This, even as the main accused, who swindled Rs 67.22 crore from the bank and are behind the bars, had received a waiver of Rs 47.79 crore from the Cooperative Department.

Mukundan and Thanka work as road-tarring labourers. They had taken a loan of Rs 30,000 from the bank way back in 2007. When its repayment was on, they had to take more loan to meet the expenses for the daughter's wedding. They were sanctioned Rs 90,000 as the loan was renewed.

While the couple defaulted in their loan repayment due to financial constraints, they received the first attachment notice from the bank on October 29, 2022. Though the duo remitted Rs 20,000 and sought time to repay the rest, they received notices for attachment twice later. The family is based at Porthikkeri in Irinjalakkuda.

Concession for swindlers!

The four bank employees who swindled Rs 67.22 crore from the Karuvannur Cooperative Bank need to remit the bank only Rs 19.43 crore. The former CPM local leaders have been extended a waiver of nearly Rs 48 crore.

However, the Co-operative Joint Registrar says that the accused have not been deliberately given any concession on repayment, but the repayment amount has been fixed on the basis of the evidence that could be unearthed from the bank. These accused are currently in jail. The irregularities at the bank are pegged at Rs 300 crore, but the government estimates it to be only Rs 150 crore.

In 2021 the bank's CPM-led governing council was sacked and it was placed under the watch of an administrator as the fraud came to light. Before that, several borrowers received recovery notices for amounts greater than they had borrowed. The borrowers approached the Registrar of Cooperatives and a probe unearthed a multi-crore scam.