Mathew Kuzhalnadan MLA vows to repay loan of Dalit family after bank attaches house

Mail This Article

Muvattupuzha: Mathew Kuzhalnadan, MLA, has assured that he would take over the debt of the Dalit family whose house was attached by the Muvattupuzha Urban Co-operative Bank for defaulting on a loan.

"I will repay the amount to the bank and get back the title deed of the house,” the Muvattupuzha MLA said.

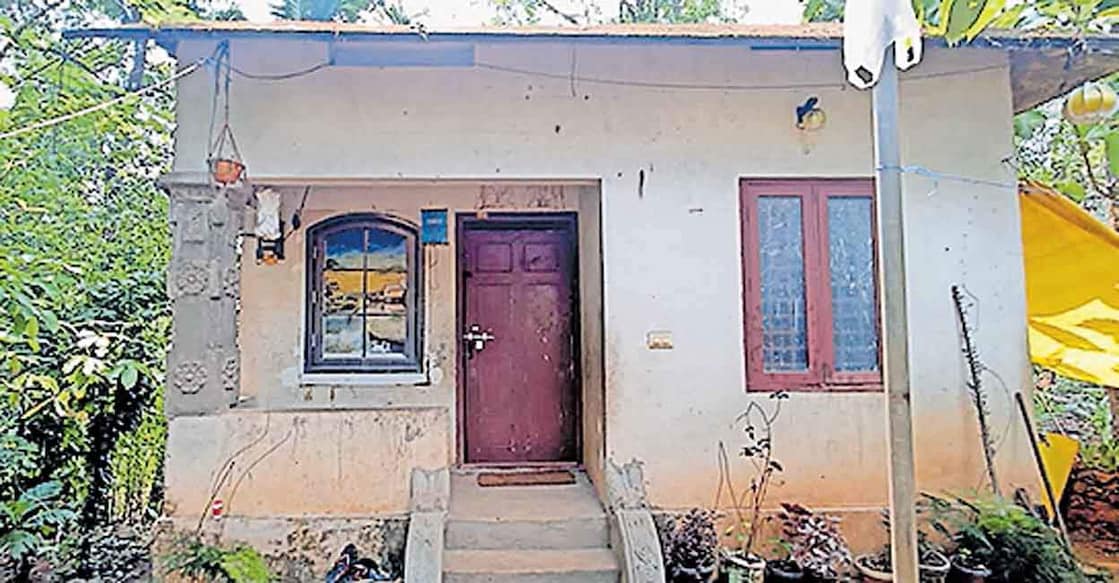

The Congress legislator broke open the sealed door lock of the house at Paipra panchayat in Muvattupuzha on Saturday after the property was attached by the bank. The house belonged to Paipra native Ajeesh.

“I will also provide help for the treatment of Ajeesh who is in hospital," the MLA added. A heart patient, Ajeesh is undergoing treatment at the General Hospital in Ernakulam.

“I broke open the lock of the house after seeing the helplessness of the minor children who were evicted from the house and their house attached while their parents were at the hospital. It is not about playing politics. Do not want to do so either," the MLA explained.

“As soon as I heard about the incident, I tried contacting bank’s chairman Gopi Kottamurikkal. I only did my duty as a people's representative when I saw the children standing on the courtyard of their house at night. I am ready to face any action over this," he added.

"The loan recovery measures should be taken with a humane approach. That did not happen in the case of this family. Even the neighbours had told the bank employees that the parents were at the hospital and more time should be given. But the officials ignored these," Mathew Kuzhalnadan said.

Break-in for political gains: Gopi Kottamurikkal

Meanwhile, Muvattupuzha Urban Co-operative Bank chairman Gopi Kottamurikkal said that the accusations and allegations over attaching the house of the Dalit family were being made for political gains.

"The action was taken after a court directive. It is not an unexpected move for the family. But as soon as we got to know that the man was in hospital, the officials were instructed to return the key. Though a woman employee of the bank went to the spot, she got scared after seeing the crowd and returned. Later the key was entrusted at the police station," Gopi Kottamurikkal claimed.

"The MLA broke open the lock and created a row for political gains," he alleged. "It has been two years since recovery proceedings were initiated. Ajeesh took the loan in 2017 to purchase a camera. After he defaulted on the loan, he was warned several times. Whenever the officials went to their place, there was no one at home. The neighbours were informed. But none had come forward to help them then. It is not right to say that the children were evicted. They only came much later. If it had been informed that their father was in hospital, the proceedings could have been stalled temporarily.

"Mathew Kuzhalnadan, MLA, and other leaders who were with him know me personally. But none of them called me. This issue could have been resolved then itself if they had informed me. But an attempt was made to escalate the issue to another level," he alleged.

SARFAESI Act

With the banks beginning to strictly enforce the SARFAESI Act to recover non-performing assets, poor families are getting evicted, as per the figures from the Assembly. The figures were revealed in response to the questions raised by Mathew Kuzhalnadan, MLA, in the Assembly after the death of a pineapple farmer.

Figures show that 5,266 properties faced revenue recovery proceedings from 2018 to March 17, under the SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest). During this period, various co-operative Banks in the state had sent 68,357 notices to those who had taken loans.

A committee appointed to study the impact of the legal proceedings of the SARFAESI Act in the state had recommended to exempt the Co-operative Banks from the purview of the Act. Despite this, banks have expedited the recovery proceedings. The committee had also recommended that the Act should be amended such that it is applicable only for loans above Rs 10 lakh instead of those below this sum.