Overseas laws, triggering of GAAR roadblock in conversion for FPIs: Experts

Mail This Article

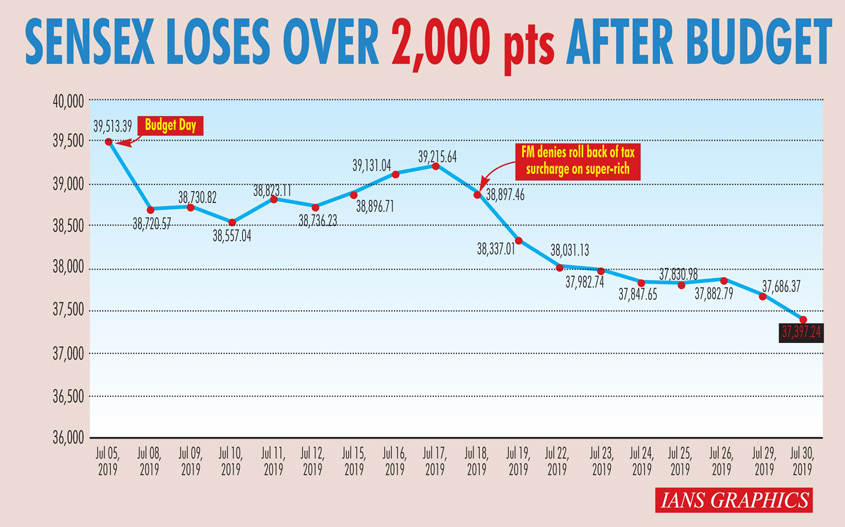

Mumbai: The increase in surcharge on super-rich proposed in the Union Budget, a negative for most Foreign Portfolio Investors (FPIs) elicited a sharply adverse reaction from the markets.

While Finance Minister Nirmala Sitharaman on July 18 ruled out any chance of a roll-back, she offered the conversion to corporate from trust structure as a solution in the face of heavy criticism overtaxing a key-driver of stocks markets.

Tax experts, however, say that the process of conversion has several complications. One, they are guided under foreign jurisdiction which differs from country to country and second, the conversion could trigger General Anti Avoidance Rules (GAAR), resulting in nullifying any benefit from the conversion.

General Anti Avoidance Rules (GAAR) allows tax officials to deny tax benefits if a deal is found without any commercial purpose other than tax avoidance.

"The procedure to switch to corporate's from trusts is governed by overseas laws because all these FPIs have been structured under their home jurisdiction laws where they are incorporated," said Amit Singhania, Partner, Shardul Amarchand Mangaldas told IANS.

Singhania further added: "However, if FPIs switch to corporate structure then tax authorities could apply General Anti Avoidance provisions to nullify the benefit of the primary purpose of shifting to a corporate structure in order to avoid a higher surcharge."

"The conversion won't be a simple trick and may consume some time, had it been simple people would have converted but we haven't heard such news," he added.

On the basis of country of incorporation, as on March 31, 2019, a total of 9,390 FPIs were registered in India from 59 different countries with a total Asset under custody (AUC )of Rs 33,42,680 crore, SEBI data shows.

Based on the country of incorporation, the number of FPIs registered was the highest from USA (3,204), followed by Luxembourg (1,080), Canada (651), Ireland (589) and Ireland (589).

In terms of AUC as well, FPIs from the USA had the maximum AUC (Rs 10,93,734 crore) followed by Mauritius (Rs 4,58,183 crore), Luxembourg (Rs 3,26,064 crore) and Singapore (Rs 3,10,179 crore).