Thiruvananthapuram: The one per cent flood cess that is being collected from people for a year-and-a-half on purchase of products will be stopped from August 1.

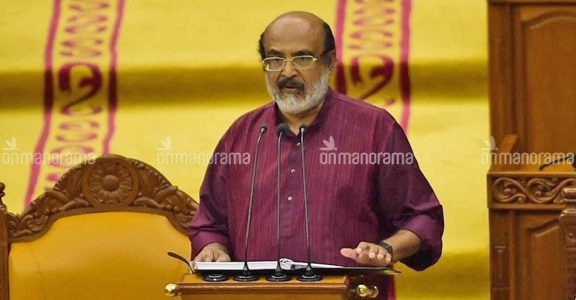

An announcement in this regard is likely to be made on Friday at 9 am in the budget to be presented by Finance Minister Thomas Isaac. The prices of gold, vehicles, electronics and home appliances will reduce if the cess is removed.

The flood cess was implemented from August 1, 2019, with the aim of collecting Rs 2,000 crore in two years to help with the recovery from the devastation caused by floods. By July, a total cess revenue will touch Rs 2,000 crore.

The cess is applicable to all products with GST rates of 12%, 18% and 28%.

Products with GST rates of 0% and 5% and traders who are presumptive taxpayers with annual turnover of up to Rs 1.5 crore were excluded from the cess.

The cess is 0.25 per cent for gold and silver with 3% GST. There is no cess on petrol, diesel, liquor and land sales.

Car will cost 1% less, gold will be cheaper by Rs 90

When the flood cess is eliminated, a sovereign of gold will become cheaper by about Rs 90, while a car priced at Rs 5 lakh will cost Rs 5,000 less.

The prices of vehicles, TV, refrigerator, washing machine, microwave oven, mixer, water heater, fan, pipe, mattress, mobile phone, laptop, computer, camera, medicines, textiles above Rs 1,000, spectacles, footwear, bag, cement, paint, marble, ceramic tile, furniture, wiring cable, insurance and movie tickets will fall by one per cent.