New Delhi: Bollywood's Amitabh Bachchan and martial arts movie star Jackie Chan are among celebrities who feature in a massive leak of documents, some of which reveal hidden offshore assets.

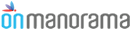

Bollywood legend Bachchan, simply known as the 'Big B', was appointed director of at least four shipping companies registered in offshore tax havens and set up 23 years ago.

The authorised capital of these companies ranged from just US$5,000 to US$50,000 but they traded in ships worth millions of dollars, according to the Indian Express.

The Express is among more than 100 media groups which have investigated a massive leak of 11.5 million documents from Mossack Fonseca, a Panama-based law firm with offices in 35 countries.

Bachchan, who has long since resigned from the companies and has not commented on the documents, is not the only member of his famous family named in the leaks.

His daughter-in-law, actress Aishwarya Rai Bachchan, was also director and shareholder of an offshore company, along with members of her family, before it was thought to have been wound up in 2008, according to the newspaper.

The media adviser of the former Miss World winner has rejected the documents as 'totally untrue and false'.

As with many of Fonseca's clients, there is no evidence that the Bollywood A-listers used their companies for improper purposes and having an offshore entity is not illegal.

But the documents, naming more than 500 Indians including real estate tycoons in Fonseca's list of offshore companies, foundations and trusts, come at a sensitive time in India.

Prime Minister Narendra Modi's government has vowed to crack down on the 'menace' of so-called black money - vast sums stashed abroad to keep them secret from Indian tax authorities.

Hong Kong film star Jackie Chan has also been revealed to have at least six companies represented by Fonseca's firm, though he too may have used the companies legitimately for business purposes rather than for tax avoidance.

The stash of records was obtained from an anonymous source by German daily Sueddeutsche Zeitung and shared with media worldwide. The documents, from around 214,000 offshore entities, cover almost 40 years.

(With inputs from agencies)